Embrace Foundation is a non-profit, educational foundation set up to create better understanding between people of different religions, cultures, traditions and world philosophies.

Embrace Foundation works to bring leaders and scholars of world-wide religions, cultures and philosophies together by sponsoring forums, seminars, lectures and developing an international exchange program. Embrace Foundation is particularly concerned with reaching the world public through the media.

Embrace Foundation works to bring leaders and scholars of world-wide religions, cultures and philosophies together by sponsoring forums, seminars, lectures and developing an international exchange program. Embrace Foundation is particularly concerned with reaching the world public through the media.

Purpose

Donations

Embrace Foundation is an all volunteer organization. All contributions go directly to programs.

Embrace Foundation does not and has never given permission to any outside organization to solicit or receive contributions on our behalf.

All donations should be made to Embrace Foundation only via Paypal or by mail. All donations are tax deductible. A receipt will be emailed to you. Please click on the Pay Pal link below to Donate.

Thank you for making a donation.

Embrace Foundation does not and has never given permission to any outside organization to solicit or receive contributions on our behalf.

All donations should be made to Embrace Foundation only via Paypal or by mail. All donations are tax deductible. A receipt will be emailed to you. Please click on the Pay Pal link below to Donate.

Thank you for making a donation.

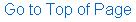

Travel As An Interfaith Act

Embrace encourages all who can do so, to learn about other traditions and cultures by traveling as “Grassroots Diplomats.” We hope that people every where become life long students of our world-wide humanity.

“ In every man there is something wherein I may learn of him, and in that I am his pupil.”

R.W.Emerson

“ In every man there is something wherein I may learn of him, and in that I am his pupil.”

R.W.Emerson

Embrace Humanity

Embrace Foundation Retreat Center

Embrace.Foundation (skype messaging) - 011+1+212.675.4500 (New York)

Click to Email Us

GREAT VISIONS

To View This TV Show - Click Here

Embrace Foundation Archives.Org

Guests are: Swami Satchidananda &

the Rt. Reverend Dean Parks Morton

Embrace Foundation Archives.Org

Guests are: Swami Satchidananda &

the Rt. Reverend Dean Parks Morton

Embrace Archives

Limited Editions Gallery

Umrah - Jordan

Sacred Places

Monastery of Bahira - Syria

Universal

Monk Reading - Ethiopia

ETHICAL ECONOMICS

INTRODUCTION

INTRODUCTION

Now that there are many nations who will be building new economic and political structures, we would like to offer some

pragmatic and idealistic insights. Embrace feels that the world economy offers many new opportunities and that much that

is breaking down in the world economic scene is corrupt and outdated.

We do not advocate any type of political system, except one that treats every individual equally by law, is not corrupt and

one that represents the best interests of all the population within a nation regardless of religion, sect, philosophy, caste,

gender, class, race, tribe or clan. The world economy, however, must change radically.

The world economy as it has existed for centuries has greatly exploited a majority of non-western nations which hold the

greatest natural resources and labor markets. It has been extremely unjust in the support of brutal, corrupt leadership in

many non-western countries and this injustice; we believe is at a pivotal point for rectification. We hope that many in the

Western, Eastern, Central and Southern parts of Africa will also soon move forward towards a more equitable change.

South America is on the verge of a renaissance, as are many countries in Asia.

Brief History

There has been much discussion with regard to government and successful economics. In reality, politics are not reflective

of economic formats, procedure or success. For instance those in the United States that are strongly allied with the current

Wall Street system, often insinuate that unfettered capitalism (Milton Friedman style) is a necessary component of

democracy. This of course, is not true. For many decades, the Scandinavian countries have had a democratic “socialism.”

(They vote for their political leaders, but their government pays for the greater needs of it’s’ citizens, including health care,

geriatric care and college tuition. - They have around 50% taxes.) Most indigenous societies are democratic and they share

communally many of their goods as well. The Republic of China has robust capitalism without democracy. Human rights

are not dependent on democracy but are necessary for a secure economy. Economies do not thrive in war.

Despite the fact that Wall Street bankers would have the public believe that there is a difference between “home grown”

pyramid schemes and their own business, the Stock Market itself has become a pyramid scheme due to insider trading as

well as, the transition from analyzing, investing and holding stocks to churning and trading stocks via algorithms in

milliseconds. Even the most staid companies now are pressured to constantly show growth. However, there always has to

be a limit to growth. Stable sales and holding portfolios especially looking out for dividend returns need to be the renewed

objectives if investors are not going to inflate the world economy out of existence.

As it is, many people in recent years have invested in non-realities, total fictions with no substance. It is much like the story

of the Emperors New Clothes. In the late 1980’s and more drastically in the ‘90‘s, (coincidentally following the break up of

the Soviet Union) there was a massive layoff of many, many employees in America. The layoffs started with executives in

the six-figure range and worked rapidly down to layoffs of many managers in the middle and lower range. With these layoffs

came a boom of independent investors and amateur traders, flush with their cashed-out 401-k’s. (Employer/employee

retirement schemes)

Miraculously inflated lines of credit attached to credit cards kept laid off employees across the USA afloat for a considerable

amount of time since those laid off could rarely find jobs, or if they did, the jobs were usually substantially below the income

they had been making prior to their redundancy. These managers had four choices; they could (if they had enough money

or lines of credit) buy a franchise, or they could open a consulting business or become entrepreneurs (once again if they

had enough money or lines of credit with their credit cards). The last option was day trading . . . trading stocks from home in

an attempt to increase their investments enough, that they could live on them.

The two primary problems of day trading was that; 1.) While the “day traders” might have understood the concept of “buy

low, sell high”, they really could not compete with the programmed trading systems of the large and midsize investment

firms and 2.) There was such a demand for investment products due to the vast numbers of people suddenly wanting to be

involved in the stock market that many laws that protected investment consumers (such as the Glass-Steagall Act) in the

midst of the frenzy were struck-down. The eradication of consumer protection laws was lobbied for by both the commercial

and investment banks. This enabled two things: a blurring of the divisions between commercial banks (where individual

consumers keep checking/ draft accounts) and investment/ merchant banks serving the business community who are

legislated to take “risks.” The result was that consumer banks holding consumer mortgages, checking/ draft accounts and

federally insured savings/ deposit accounts were now legislated to take risks with Wall Street financial instruments.

One note needs to be made. At the time banks began lobbying to end the Glass-Steagall Act (in the USA) few people were

keeping savings accounts in commercial banks. The commercial banks could not offer the interest rates that were possible

in the stock market or even the interest rates that the mainstream bond market could offer. Prior to all this, the growth

potential for commercial banks was secure but fairly stagnant until they started heavy risk marketing in credit card debt and

subsequently enjoined this risk with the additional risk of Wall Street financial instruments.

Start-up companies that should have been reserved as only venture capital preserves were being offered on NASDAQ as

legitimate businesses to the inexperienced public when in fact they were little more than “ideas”. These companies often

had almost no assets or equity and often the “product” or “service” was only in the prototype stage.

These were the early signs of an economic breakdown. The out of control banks with phony derivative packages, junk

bonds, insurance hedges etc… have been documented ad infinitum. Few of the executives or managers who lost their jobs

beginning in the late ‘80s through to the end of the ‘90s ever regained the same corporate foothold they had before being

made redundant. Many families took a major downward shift in lifestyle from this time forward.

Our Conclusion

Free market banks are a problem sooner or later. For strengthening a local economy and your own community the

strongest, most enduring and generally the most ethical mode of depositing capital is with a member/owner, non-profit

credit union. Credit Unions have open meetings and must answer the questions of any of it’s’ owner/ members. These

banks also need to be backed up by depositor insurance.

The New Investment Market

With a worldwide depression created by Wall Street (which is now in decline in “real” trades versus geographically

diversified millisecond micro traders) to once again serve the interests of the global economy must change substantially.

We expect that the new stock market will very likely develop into a direct seller to buyer market, via the internet, without

the investment/ merchant banks underwriting or making new share offerings. Major corporations around the world are easily

capable of making this change. Venture Capital firms in the future will most likely have to assist new clients in bringing out

their Initial Public Offerings.

Whatever needs to be done with regard to issuing corporate bonds, overseeing proxy issues, issuing new convertible

stocks, money market instruments or preferred stocks, etc., can be done by the “in-house” MBA’s at major corporations. In

fact, Wall Street is already outdated. We suspect it is only a matter of time before pension funds and mutual funds will find it

easier, more cost effective and definitely more confidential to deal directly with corporate trading rooms than with

investment bank intermediaries, given the opportunity.

There is nothing at present to stop the “New Market” except the momentum of people doing what they have always done.

However, the truth is that all major corporations, especially the largest multi-nationals are capable of holding positions and

selling directly to pension funds, mutual funds and individuals who wish to buy stocks from their in-house traders without

going through investment bank intermediaries. Let’s face it; most of the questionable business that goes on in the

investment market comes from the intermediaries. Insider trading requires an intermediary. Issuing bogus stocks requires

an intermediary. Using retail accounts to cover institutional losses, (think Bear Stearns) requires a middleman.

It is easier for the SEC and other international regulatory bodies to regulate individual corporations and keep track of their

relatively straight forward trades than it is to regulate highly suspect investment banks holding hundreds of investment

instruments, some with retail accounts insinuating perhaps tens of thousands of clients and positions in hundreds of

companies. Mutual funds, of course, hold a wide variety of funds on behalf of investors, but again, they are much easier to

investigate and regulate.

Government Instruments

Governments, federal and regional can offer securities directly to consumers without investment institutions. They are

capable of operating their own trading of bonds, bills and notes.

Many Job Opportunities In The New System

Hundreds of thousands of people in the USA and Europe have lost their jobs on every level in the banking and investment

community. A direct buyer to seller market would create more jobs in the financial sector than there are unemployed

bankers and traders to fill them. Every public company, as well as every county/ province, state and federal government

wishing to offer debt instruments would require in-house traders, computer trading programs, etc, etc… The change would

also require a considerable amount of advertising to inform the public of what is on offer. New financial newsletters for

analysis would be developed to assist both pension fund managers, mutual fund managers and individuals to existing

opportunities and pitfalls. People would need to go to school to learn trading, economics and finance to secure careers

working for corporate trading departments and for government in-house trading. Classes would be required to update

current financial managers serving individuals. Stockbrokers would require completely new training, as they would be

compelled to work without institutional backing.

Regional International Trade

Small, mid-size to large manufacturers primarily private, as well as, independent consultants, artisans, crafts people and

farmers may if they choose, begin organizing cooperatives that enable them to dialogue directly with regional communities

across the world that need or desire their goods.

It is possible that small and midsize companies will raise capital independently, such as Ben Cohen and Jerry Greenfield

did for the initial public offering of Ben & Jerry‘s Ice Cream (in the USA.) These entrepreneurs sold their company stock at

community meetings directly to the public.

Profit Sharing

Over the years whenever there has been a deadlock between labor and management of airlines in the USA a profit sharing

scheme is introduced. It works for a while and eventually it returns to business as usual. Profit sharing means all

employees hold an interest (stocks) in the company as partial owners in lieu of additional pay.

In the past, profit sharing has not endured because there was no incentive to keep it working. However, profit sharing can be

highly successful and offers an opportunity to start up new ventures and keep current ones solvent.

Conclusion

We believe the coming “New Markets” will be direct and very transparent. We believe that regional co-operatives worldwide

will operate efficiently and successfully. We believe profit sharing will be a means to launch new small businesses and keep

current ones solvent and profitable. We believe the “New Direct Market” offers many, many new job opportunities within

corporations and within auxiliary services. Finally, we believe all the above will offer a more ethical and profitable means of

doing business around the world.

UPDATE Failed U.S. Banks 2007 - 2014

Please Note: Since 2007 the total number of banks that have failed in the USA is now 509 - November 2014

Virginia (Embrace), Dr.Anwar Barkat (World Council of Churches, UN) & Imam I.H. Kauser

Embrace Archives

Embrace Foundation International

- Great Visions TV

- Inspirations

- Media

- Possibilities

- Astrophysics, Quantum Physics & The Nature of Reality

- Deconstructing Nuclear Fission & Nuclear Waste

- Defense Industry as Community Builders

- Defense Industry As Energy Providers

- Global Water Shortages

- Innovative Technology

- Intelligent Communities & Development

- Pentagon & Non-Western Nations

- Recreating

- Resource Based Population

- Sharing Community Resources

- Protecting Human Rights

- Spiritual Ecology

- Syria

- Write to Us