Embrace Foundation Retreat Center

Embrace.Foundation (skype messaging) - 011+1+212.675.4500 (New York)

Click to Email Us

Ethical Economics

Economics without Politics

( Scroll down for additional articles)

Like so many statistics about Africa's boom times, the figures about its companies seem at odds with the realities we see and

hear.

- There will have to be a corporate information revolution

At first glance, our survey of the continent's Top 500 companies shows that Africa's corporate giants - their combined

turnovers have tripled to around $740bn over the past decade - are racing ahead.

But it is equally important to look at the African continent's gross domestic product - estimated to be about $1.8trn in 2013 -

and ask why that is well over double the turnover of Africa's top 500 companies.

The conclusion is that Africa's companies are missing in action from some of the brightest spots on the economic horizon.

Even Africa's biggest companies are growing more slowly on average than its national economies.

That is partly because Africa's biggest revenues, in oil and mineral exports mainly denominated in US dollars, accrue to

multinational, not local companies.

Likewise with agricultural production, which is growing rapidly in many countries.

Its growth is either measured through rising dollar-earning exports of soft commodities such as coffee, cocoa and tea, through

the declining role of state commodity boards or through estimates of the size of the informal economies in the countryside.

And going down the corporate rankings to those companies that did not make the Top

500, our research suggests that their turnover is shrinking: as much as 23% between 2011 and 2012.

Capital market research shows also that the rate of new companies listing on African stock exchanges has been falling

sharply. That generally means less accountability and less access to investor funds.

Some regional factors, such as the political turmoil in North Africa, help explain the lack lustre performance of African

companies.

Equally, local companies in some sectors such as information technology and telecommunications are booming by any

standards.

Services too are growing, but the dependence on unprocessed exports is, if anything,

intensifying.

The performance of Africa's processing and manufacturing companies, which will create the jobs of the future, is lagging

behind.

The average share of manufacturing in African economies remains at around 10%, where it has been for the past 40 years.

Changing this and championing Africa's companies will require policy innovation, political will and an information revolution.

The latest research from the African Development Bank (AfDB) and the World Bank on the factory floor dismisses the

shibboleth that African companies cannot compete in terms of productivity or unit labour costs.

But both organisations urge governments to shed their suspicion of local governments, which may be rooted in fears of a

political challenge from independently wealthy individuals.

Fixing electric power and transport would be a huge boost to local companies, and in

most cases that requires determined state action.

So, too, does the financial industry.

Now is the time for governments to stipulate that all commodity exporters should repatriate their export earnings through

domestic banking systems. Angola introduced such rules in 2011.

Provided the national banking system is properly regulated, this will boost transparency and allow for a more accurate

measure of real output and export earnings.

It will also boost the availability of foreign exchange to the local market and help the development of local money markets.

Finally, for Africa's companies to attract substantially more local and foreign investment, there will have to be a corporate

information revolution.

Although the AfDB is making headway on improving macro and microeconomic data, there is still a lack of corporate data and

independent analysis of companies' performances of the kind readily available in Asia and South America.

That will also allow policymakers to identify more easily the illicit outflows of finance - through tax evasion and deliberate

mispricing of contracts - another factor that is limiting the financing prospects for local companies.

Serious action is needed now if Africa's companies are not to miss out on the growth.

Read the original article on Theafricareport.com: Africa's missing companies

Posted on Friday, 31 January 2014 12:50

Africa's missing companies

By

Patrick Smith

Patrick Smith

MUHAMMAD YUNUS

The "Banker To The Poor"

Explains How Social Businesses Can Create

Jobs For Everyone

Interview from the ROTARIAN Magazine

The "Banker To The Poor"

Explains How Social Businesses Can Create

Jobs For Everyone

Interview from the ROTARIAN Magazine

Nobel Peace Prize winner Muhammad Yunus, known as the “banker for the poor”, began transforming lives while an

economics professor at the University of Chittagong in Bangladesh. What began as personal microloans to poor women in

nearby villages grew into Grameen Bank, which today has more than 2,500 branches throughout the country. Grameen Bank

has helped launch or expand the businesses of more than 8 million borrowers - 97 percent of them women. Yunus, a keynote

speaker at the 2012 RI Convention, recently spoke with Warren Kalbacker, a frequent contributor to The Rotarian.

The Rotarian: In 1976, you introduced the concept of microcredit, which involves providing loans of as little as a few cents to

individuals. Many businesspeople might be puzzled as to how lending such small amounts could be effective.

Yunus: Microcredit started in one village in Bangladesh. I was teaching economics, and the country was going through famine.

I was frustrated because the economic theories I taught in the classroom didn’t have any meaning in the lives of poor people. I

thought I’d try to do something to help individuals in the village next to the university campus. I noticed loan sharking in the

village - people lending money to the poor with terrible conditions attached. The sharks took control of peoples’ lives. I thought I

could solve this problem by lending money myself. I visited those who were borrowing from the loan sharks, and I made a list of

42 names. The total money they owed was the equivalent of US$27. I put the money in their hands to pay off the loan sharks so

they could be free. When I did that, everybody got excited. If such a small amount of money could make so many people so

happy, I thought I should do more of it.

TR: Your concept of social business involves raising and investing capital, then managing the enterprise for a return. Yet you

specify that there will be no profit-taking. Aren’t you offering something like two cheers for capitalism?

Yunus: People think if you take out the profit incentive, businesses cannot survive. That’s absolutely wrong. There are many

other incentives. In a social business, I make other people happy. By making other people happy, I become happy. That

incentive is something economists don’t understand. I am introducing that. I’m not walking out on capitalism; I insist that

capitalism is misinterpreted. It’s based on a single type of business: profit-making. It’s imbalanced. If you add the social

business leg to the capitalist system, then it becomes stable. When a business is run only to maximize profit, people are too

busy to examine or solve social problems, so they let governments take care of those problems. But we citizens are capable of

solving problems ourselves. That’s what the social business can do.

TR: Grameen has teamed up with France-based food giant Danone to manufacture yogurt in Bangladesh. How does this

venture differ from a traditional profit-making enterprise?

Yunus: This social business is a non-loss, non-dividend company designed to solve a social problem. If Grameen Danone

Foods makes a profit, the profit stays with the company. Its purpose is to solve the problem of malnutrition among the children

of Bangladesh. It makes a special type of yogurt that is inexpensive to produce and affordable to the poorest families. If a child

eats it, he or she gradually becomes a healthy child. The company is now in its fourth year, and it’s doing very well. The

nutritional impact is clear, and the company is approaching the break-even point.

TR: You’re a tireless advocate for personal initiative across all cultures. What motivates you?

Yunus: Economists assume that entrepreneurs who can take the risks and lead the way are limited in number - that these are

the few people in the world with exceptional qualities, who are capable of being entrepreneurs, and the rest of the human

beings are supposed to work under them. This is unacceptable. I insist that all human beings are entrepreneurs. No

exceptions. No one lacks entrepreneurial capability. But institutions have framed policies that don’t give us the opportunity to

discover our entrepreneurial ability. They’re being propagated through our education system, which is built on the premise that

you work hard and get well paid, or you go to a good school and get a good job - as if a job is the ultimate goal of a human life. I

say that is wrong.

TR: What will you focus on when you address this year’s RI Convention?

Yunus: I’ll be talking about the education system. All young people should be taught that they have choices. They can be a job

seeker or a job giver. As they grow up, they can decide which they want to be. Institutions must be built so that whichever path

young people take, they will be supported so they can pursue their goal in life. Right now, this choice is missing in the

education system.

TR: Many graduates of top US. colleges and universities are having a tough time in the job market. Can you offer this talent

pool some career advice?

YUNUS: I would say, "Why try to be a job seeker? Why don't you become a job giver?" Create a social business to provide

opportunities. If you work ill the social business you have started, you've actually created your own job. Whatever salary you

may expect in an open market, you can get the same salary in your own company. so you're not sacrificing anything. All you

are saying is, ''I'm not taking any profit out of the company."

TR: You have advised Lisa Simpson, the older daughter on the long running animated TV show The Simpsons, on how to

direct S50 toward a socially responsible investment. How did that get into the script?

YUNUS: I suggested Lisa give the money out in micro credit. Yeardley Smith, the voice of Lisa Simpson, is a close friend. She

knows about social business. We keep inviting her to come to a Global Social Business Summit. We just had one in Vienna.

Maybe there will be another Simpsons episode on social business. Lisa could start a problem-solving business.

TR: Many affluent people donate substantial sums of money to alleviate poverty. Do you seek to reorient philanthropy?

YUNUS: I am not against philanthropy. It's very important and should continue. Bur I am proposing that there are occasions

when you can convert philanthropy into a social business, and it works much better. It's not rocket science. You can use your

philanthropy money to start a company and create five jobs for people who are unemployed. Start a fruit stand. Start a

restaurant. You have employed people, and they have good jobs. The intention is to provide the five jobs. not to make money

from the restaurant. As long as the restaurant covers its own costs, that's fine. And if it's making a profit, the profit stays with

the company so that it can create a sixth job or a seventh job.

TR: You are skeptical of aspects of the social safety nets in Western countries, noting that they can impede entrepreneurship.

How would you approach Western poverty?

YUNUS: You can take people off welfare by creating a social business. You have then done a tremendous thing. You've saved

the government from continuously having to feed them, and you have saved them from that rotten feeling that they are useless

people who can do nothing for themselves. You have saved five people economically, psychologically and socially. You have

given them dignity.

TR: You've predicted that people will someday learn about poverty only by viewing museum exhibits. Are you really that

optimistic?

YUNUS: Yes. I am convinced that it's possible with the United Nations Millennium Development Goals. The No.1 goal is to

reduce poverty and hunger. We need to attack this in every way. We need education, health care, and micro credit. We need

good governance. We need to protect the planer. We need everything. If you say, "This one thing will solve the problem of

poverty," I don't agree.

TR: "Do it with joy" is one of the seven written principles of the Yunus concept for a social business. How do you manage that?

YUNUS: You must enjoy what you are doing. Joy comes from within you. And once you see that it's happening, you are able to

make other people happy. That touches you. It's wonderful.

TR: Grameen faltered a bit with its textile venture, Grameen Check. Were its products too expensive for the mass market? Do

you think the checked cloth might have a future with fashion designers?

YUNUS: We are trying. It is not expensive to produce. We tried to build an international demand and didn't do a very good job.

But in the process, it's become well liked in Bangladesh. All the young people here want to wear Grameen Check because they

feel this gives recognition and dignity to the weavers in Bangladesh who weave this cloth by hand. It comes in thousands and

thousands of colors and designs. I am wearing Grameen Check right now.

APRIL 2012 I THE ROTARIAN

Link to ROTARY.ORG

YOU CAN TAKE PEOPLE OFF WELFARE BY

CREATING A SOCIAL BUSINESS. YOU HAVE THEN SAVED THE GOVERNMENT FROM HAVING TO

FEED THEM.

AND YOU HAVE GIVEN THEM DIGNITY.

Titanic Banks Hit LIBOR Iceberg:

Will Lawsuits Sink the Ship?

Posted on July 20, 2012 by Ellen Brown

Will Lawsuits Sink the Ship?

Posted on July 20, 2012 by Ellen Brown

At one time, calling the large multinational banks a “cartel” branded you as a conspiracy theorist. Today the banking giants are

being called that and worse, not just in the major media but in court documents intended to prove the allegations as facts.

Charges include racketeering (organized crime under the U.S. Racketeer Influenced and Corrupt Organizations Act or RICO),

antitrust violations, wire fraud, bid-rigging, and price-fixing. Damning charges have already been proven, and major damages

and penalties assessed. Conspiracy theory has become established fact.

In an article in the July 3rd Guardian titled “Private Banks Have Failed - We Need a Public Solution”, Seumas Milne writes of the

LIBOR rate-rigging scandal admitted to by Barclays Bank:

It’s already clear that the rate rigging, which depends on collusion, goes far beyond Barclays, and indeed the City of London.

This is one of multiple scams that have become endemic in a disastrously deregulated system with inbuilt incentives for

cartels to manipulate the core price of finance.

. . . It could of course have happened only in a private-dominated financial sector, and makes a nonsense of the bankrupt free-

market ideology that still holds sway in public life.

. . . A crucial part of the explanation is the unmuzzled political and economic power of the City. . . . Finance has usurped

democracy.

Bid-rigging and Rate-rigging

Bid-rigging was the subject of U.S. v. Carollo, Goldberg and Grimm, a ten-year suit in which the U.S. Department of Justice

obtained a judgment on May 11 against three GE Capital employees. Billions of dollars were skimmed from cities all across

america by colluding to rig the public bids on municipal bonds, a business worth $3.7 trillion. Other banks involved in the

bidding scheme included Bank of America, JPMorgan Chase, Wells Fargo and UBS. These banks have already paid a total of

$673 million in restitution after agreeing to cooperate in the government’s case.

Hot on the heels of the Carollo decision came the LIBOR scandal, involving collusion to rig the inter-bank interest rate that

affects $500 trillion worth of contracts, financial instruments, mortgages and loans. Barclays Bank admitted to regulators in

June that it tried to manipulate LIBOR before and during the financial crisis in 2008. It said that other banks were doing the

same. Barclays paid $450 million to settle the charges.

The U. S. Commodities Futures Trading Commission said in a press release that Barclays Bank “pervasively” reported

fictitious rates rather than actual rates; that it asked other big banks to assist, and helped them to assist; and that Barclays did

so “to benefit the Bank’s derivatives trading positions” and “to protect Barclays’ reputation from negative market and media

perceptions concerning Barclays’ financial condition.”

After resigning, top executives at Barclays promptly implicated both the Bank of England and the Federal Reserve. The upshot

is that the biggest banks and their protector central banks engaged in conspiracies to manipulate the most important market

interest rates globally, along with the exchange rates propping up the U.S. dollar.

CFTC did not charge Barclays with a crime or require restitution to victims. But Barclays’ activities with the other banks appear

to be criminal racketeering under federal RICO statutes, which authorize victims to recover treble damages; and class action

RICO suits by victims are expected.

The blow to the banking defendants could be crippling. RICO laws, which carry treble damages, have taken down the Gambino

crime family, the Genovese crime family, Hell’s Angels, and the Latin Kings.

The Payoff: Not in Interest But on Interest Rate Swaps

Bank defenders say no one was hurt. Banks make their money from interest on loans, and the rigged rates were actually

LOWER than the real rates, REDUCING bank profits.

That may be true for smaller local banks, which do make most of their money from local lending; but these local banks were

not among the 16 mega-banks setting LIBOR rates. Only three of the rate-setting banks were U.S.banks-JPMorgan, Citibank

and Bank of America-and they slashed their local lending after the 2008 crisis. In the following three years, the four largest U.S.

banks-BOA, Citi, JPM and Wells Fargo--cut back on small business lending by a full 53 percent. The two largest-BOA and Citi-

cut back on local lending by 94 percent and 64 percent, respectively.

Their profits now come largely from derivatives. Today, 96% of derivatives are held by just four banks-JPM, Citi, BOA and

Goldman Sachs-and the LIBOR scam significantly boosted their profits on these bets. Interest-rate swaps compose fully 82

percent of the derivatives trade. The Bank for International Settlements reports a notional amount outstanding as of June 2009

of $342 trillion. JPM-the king of the derivatives game-revealed in February 2012 that it had cleared $1.4 billion in revenue trading

interest-rate swaps in 2011, making them one of the bank’s biggest sources of profit.

The losers have been local governments, hospitals, universities and other nonprofits. For more than a decade, banks and

insurance companies convinced them that interest-rate swaps would lower interest rates on bonds sold for public projects

such as roads, bridges and schools.

The swaps are complicated and come in various forms; but in the most common form, counterparty A (a city, hospital, etc.)

pays a fixed interest rate to counterparty B (the bank), while receiving a floating rate indexed to LIBOR or another reference

rate. The swaps were entered into to insure against a rise in interest rates; but instead, interest rates fell to historically low

levels.

Defenders say “a deal is a deal;” the victims are just suffering from buyer’s remorse. But while that might be a good defense if

interest rates had risen or fallen naturally in response to demand, this was a deliberate, manipulated move by the Fed acting to

save the banks from their own folly; and the rate-setting banks colluded in that move. The victims bet against the house, and

the house rigged the game.

Lawsuits Brewing

State and local officials across the country are now meeting to determine their damages from interest rate swaps, which are

held by about three-fourths of America’s major cities. Damages from LIBOR rate-rigging are being investigated by

Massachusetts Attorney General Martha Coakley, New York Attorney General Eric Schneiderman, officers at CalPERS

(California’s public pension fund, the nation’s largest), and hundreds of hospitals.

One victim that is fighting back is the city of Oakland, California. On July 3, the Oakland City Council unanimously passed a

motion to negotiate a termination without fees or penalties of its interest rate swap with Goldman Sachs. If Goldman refuses,

Oakland will boycott doing future business with the investment bank. Jane Brunner, who introduced the motion, says ending

the agreement could save Oakland $4 million a year, up to a total of $15.57 million-money that could be used for additional city

services and school programs. Thousands of cities and other public agencies hold similar toxic interest rate swaps, so

following Oakland’s lead could save taxpayers billions of dollars.

What about suing Goldman directly for damages? One problem is that Goldman was not one of the 16 banks setting LIBOR

rates. But victims could have a claim for unjust enrichment and restitution, even without proving specific intent:

Unjust enrichment is a legal term denoting a particular type of causative event in which one party is unjustly enriched at the

expense of another, and an obligation to make restitution arises, regardless of liability for wrongdoing. . . . [It is a] general

equitable principle that a person should not profit at another’s expense and therefore should make restitution for the reasonable

value of any property, services, or other benefits that have been unfairly received and retained.

Goldman was clearly unjustly enriched by the collusion of its banking colleagues and the Fed, and restitution is equitable and

proper.

RICO Claims on Behalf of Local Banks

Not just local governments but local banks are seeking to recover damages for the LIBOR scam. In May 2012, the Community

Bank & Trust of Sheboygan, Wisconsin, filed a RICO lawsuit involving mega-bank manipulation of interest rates, naming Bank

of America, JPMorgan Chase, Citigroup, and others. The suit was filed as a class action to encourage other local, independent

banks to join in. On July 12, the suit was consolidated with three other LIBOR class action suits charging violation of the anti-

trust laws.

The Sheboygan bank claims that the LIBOR rigging cost the bank $64,000 in interest income on $8 million in floating-rate loans

in 2008. Multiplied by 7,000 U.S. community banks over 4 years, the damages could be nearly $2 billion just for the community

banks. Trebling that under RICO would be $6 billion.

RICO Suits Against Banking Partners of MERS

Then there are the MERS lawsuits. In the State of Louisiana, 30 judges representing 30 parishes are suing 17 colluding banks

under RICO, stating that the Mortgage Electronic Registration System (MERS) is a scheme set up to illegally defraud the

government of transfer fees, and that mortgages transferred through MERS are illegal. A number of courts have held that

separating the promissory note from the mortgage-which the MERS scheme does-breaks the chain of title and voids the

transfer.

Several states have already sued MERS and their bank partners, claiming millions of dollars in unpaid recording fees and other

damages. These claims have been supported by numerous studies, including one asserting that MERS has irreparably

damaged title records nationwide and is at the core of the housing crisis. What distinguishes Louisiana’s lawsuit is that it is

being brought under RICO, alleging wire and mail fraud and a scheme to defraud the parishes of their recording fees.

Readying the Lifeboats: The Public Bank Solution

Trebling the damages in all these suits could sink the bank of Titanic. As Seumas Milne notes in The Guardian:

Tougher regulation or even a full separation of retail from investment banking will not be enough to shift the City into productive

investment, or even prevent the kind of corrupt collusion that has now been exposed between Barclays and other banks. . . .

Only if the largest banks are broken up, the part-nationalised outfits turned into genuine public investment banks, and new

socially owned and regional banks encouraged can finance be made to work for society, rather than the other way round.

Private sector banking has spectacularly failed - and we need a democratic public solution.

If the last quarter century of U.S. banking history proves anything, it is that our private banking system turns malignant and

feeds off the public when it is deregulated. It also shows that a parasitic private banking system will NOT be tamed by

regulation, as the banks’ control over the money power always allows them to circumvent the rules. We the People must

transparently own and run the nation’s central and regional banks for the good of the nation, or the system will be abused and

run for private power and profit as it so clearly is today, bringing our nation to crisis again and again while enriching the few.

Ellen Brown is an attorney and president of the Public Banking Institute, http://PublicBankingInstitute.org. In Web of Debt, her latest of

eleven books, she shows how a private cartel has usurped the power to create money from the people themselves, and how we the people

can get it back. Her websites are http://WebofDebt.com and http://EllenBrown.com.

Embrace Foundation is a non-profit,

educational foundation set up to create

better understanding between people of

different religions, cultures, traditions and

world philosophies.

Embrace Foundation works to bring leaders

and scholars of world-wide religions,

cultures and philosophies together by

sponsoring forums, seminars, lectures and

developing an international exchange

program. Embrace Foundation is particularly

concerned with reaching the world public

through the media.

Purpose

Donations

Embrace Foundation is an all volunteer

organization. All donations go directly to

programs.

Embrace Foundation does not and has

never given permission to any outside

organization to solicit or receive

contributions on our behalf.

All donations should be made to Embrace

Foundation only via Paypal or by mail. All

donations are tax deductible. A receipt will

be emailed to you. Please click on the Pay

Pal link below to Donate.

Travel As An Interfaith Act

Embrace encourages all who can do so, to

learn about other traditions and cultures by

traveling as “Grassroots Diplomats.” We

hope that people every where become life

long students of our world-wide humanity.

“ In every man there is something wherein I

may learn of him, and in that I am his pupil.”

R.W.Emerson

Embrace Humanity

Great Visions - TV

Guests are: Swami Satchidananda &

the Rt. Reverend Dean Parks Morton

Embrace Archives

Limited Editions Gallery

Umrah - Jordan

Embrace Sacred Places

Monastery of Bahira - Syria

Embrace Foundation Universal

Monk Reading - Ethiopia

Thank you for making a donation.

Virginia (Embrace), Dr.Anwar Barkat (World Council of Churches, UN) & Imam I.H. Kauser

Embrace Archives

Great Visions TV

Anne-Stuart & Ajata (Hosts), with Rabbi Gelberman & Dr.Jayaraman

Anne-Stuart & Ajata (Hosts), with Rabbi Carlebach & Imam Kauser

Embrace Foundation International

A Revolutionary Pope Calls for Rethinking the Outdated Criteria That Rule the World

Ellen Brown, Author, Web of Debt, Public Bank Solution; President, Public Banking Institute

Posted: 07/08/2015 3:58 pm EDT Updated: 07/08/2015 3:59 pm EDT

Pope Francis' revolutionary encyclical addresses not just climate change but the banking crisis. Interestingly, the solution to

that crisis may have been modeled in the Middle Ages by Franciscan monks following the Saint from whom the Pope took his

name.

Pope Francis has been called "the revolutionary Pope" Before he became Pope Francis, he was a Jesuit Cardinal in Argentina

named Jorge Mario Bergoglio, the son of a rail worker. Moments after his election, he made history by taking on the name

Francis, after Saint Francis of Assisi, the leader of a rival order known to have shunned wealth to live in poverty.

Pope Francis' June 2015 encyclical is called "Praised Be," a title based on an ancient song attributed to St. Francis. Most

papal encyclicals are addressed only to Roman Catholics, but this one is addressed to the world. And while its main focus is

considered to be climate change, its 184 pages cover much more than that. Among other sweeping reforms, it calls for a

radical overhaul of the banking system. It states in Section IV:

"Today, in view of the common good, there is urgent need for politics and economics to enter into a frank dialogue in the

service of life, especially human life. Saving banks at any cost, making the public pay the price, forgoing a firm commitment to

reviewing and reforming the entire system, only reaffirms the absolute power of a financial system, a power which has no

future and will only give rise to new crises after a slow, costly and only apparent recovery. The financial crisis of 2007-08

provided an opportunity to develop a new economy, more attentive to ethical principles, and new ways of regulating speculative

financial practices and virtual wealth. But the response to the crisis did not include rethinking the outdated criteria which

continue to rule the world.

. . . A strategy for real change calls for rethinking processes in their entirety, for it is not enough to include a few superficial

ecological considerations while failing to question the logic which underlies present-day culture."

"Rethinking the outdated criteria which continue to rule the world" is a call to revolution, one that is necessary if the planet and

its people are to survive and thrive. Beyond a change in our thinking, we need a strategy for eliminating the financial parasite

that is keeping us trapped in a prison of scarcity and debt.

Interestingly, the model for that strategy may have been created by the Order of the Saint from whom the Pope took his name.

Medieval Franciscan monks, defying their conservative rival orders, evolved an alternative public banking model to serve the

poor at a time when they were being exploited with exorbitant interest rates.

The Franciscan Alternative: Banking for the People

In the Middle Ages, the financial parasite draining the people of their assets and livelihoods was understood to be "usury" -

charging rent for the use of money. Lending money at interest was forbidden to Christians, as a breach of the prohibition on

usury proclaimed by Jesus in Luke 6:33. But there was a serious shortage of the precious metal coins that were the official

medium of exchange, creating a need to expand the money supply with loans on credit.

An exception was therefore made to the proscription against usury for the Jews, whose Scriptures forbade usury only to

"brothers" (meaning other Jews). This gave them a virtual monopoly on lending, however, allowing them to charge excessively

high rates because there were no competitors. Interest sometimes went as high as 60 percent.

These rates were particularly devastating to the poor. To remedy the situation, Franciscan monks, defying the prohibitions of

the Dominicans and Augustinians, formed charitable pawnshops called montes pietatus (pious or non-speculative collections

of funds). These shops lent at low or no interest on the security of valuables left with the institution.

The first true mons pietatis made loans that were interest-free. Unfortunately, it went broke in the process. Expenses were to

come out of the original capital investment; but that left no money to run the bank, and it eventually had to close.

Franciscan monks then established montes pietatis in Italy that lent at low rates of interest. They did not seek to make a profit

on their loans. But they faced bitter opposition, not only from their banking competitors but from other theologians. It was not

until 1515 that the montes were officially declared to be meritorious.

After that, they spread rapidly in Italy and other European countries. They soon evolved into banks, which were public in nature

and served public and charitable purposes. This public bank tradition became the modern European tradition of public,

cooperative and savings banks. It is particularly strong today in the municipal banks of Germany called Sparkassen.

The public banking concept at the heart of the Sparkassen was explored in the 18th century by the Irish philosopher Bishop

George Berkeley, in a treatise called The Plan of a National Bank. Berkeley visited America and his work was studied by

Benjamin Franklin, who popularized the public banking model in colonial Pennsylvania. In the US today, the model is

exemplified in the state-owned Bank of North Dakota.

From "Usury" to "Financialization"

What was condemned as usury in the Middle Ages today goes by the more benign term "financialization" - turning public

commodities and services into "asset classes" from which wealth can be siphoned by rich private investors. Far from being

condemned, it is lauded as the way to fund development in an age in which money is scarce and governments and people

everywhere are in debt.

Land and natural resources, once considered part of the commons, have long been privatized and financialized. More recently,

this trend has been extended to pensions, health, education and housing. Today financialization has entered a third stage, in

which it is invading infrastructure, water, and nature herself. Capital is no longer content merely to own. The goal today is to

extract private profit at every stage of production and from every necessity of life.

The dire effects can be seen particularly in the financialization of food. The international food regime has developed over the

centuries from colonial trading systems to state-directed development to transnational corporate control. Today the trading of

food commodities by hedgers, arbitrageurs and index speculators has disconnected markets from the real-world demand for

food. The result has been sudden shortages, price spikes and food riots. Financialization has turned farming from a small

scale, autonomous and ecologically-sustainable craft to a corporate assembly process that relies on patented technologies

and equipment increasingly financed through debt.

We have bought into this financialization scheme based on a faulty economic model, in which we have allowed money to be

created privately by banks and lent to governments and people at interest. The vast majority of the circulating money supply is

now created by private banks in this way, as the Bank of England recently acknowledged.

Meanwhile, we live on a planet that holds the promise of abundance for all. Mechanization and computerization have

streamlined production to the point that, if the work week and corporate profits were divided equitably, we could be living lives

of ease, with our basic needs fulfilled and plenty of leisure to pursue the interests we find rewarding. We could, like St. Francis,

be living like the lilies of the field. The workers and materials are available to build the infrastructure we need, provide the

education our children need, provide the care the sick and elderly need. Inventions are waiting in the wings that could clean up

our toxic environment, save the oceans, recycle waste, and convert sun, wind and perhaps even zero-point energy into usable

energy sources.

The holdup is in finding the funding for these inventions. Our politicians tell us "we don't have the money." Yet China and some

other Asian countries are powering ahead with this sort of sustainable development. Where have they found the money?

The answer is that they simply issue it. What private banks do in Western countries, publicly-owned and -controlled banks do

in many Asian countries. Their governments have taken control of the engines of credit - the banks - and operated them for the

benefit of the public and their own economies.

What blocks Western economies from pursuing that course is a dubious economic theory called "monetarism." It is based on

the premise that "inflation is always and everywhere a monetary phenomenon," and that the chief cause of inflation is money

"created out of thin air" by governments. In the 1970s, the Basel Committee discouraged governments from issuing money

themselves or borrowing from their own central banks which issued it. Instead they were to borrow from "the market," which

generally meant borrowing from private banks. Overlooked was the fact, recently acknowledged by the Bank of England, that

the money borrowed from banks is also created out of thin air. The difference is that bank-created money originates as a debt

and comes with a hefty private interest charge attached.

We can break free from this exploitative system by returning the power to create money to governments and the people they

represent. The strategy for real change called for by Pope Francis can be furthered with government-issued money of the sort

originated by the American colonists, augmented by a network of publicly-owned banks of the sort established by the Order of

St. Francis in the Middle Ages.

Ellen Brown is an attorney, founder of the Public Banking Institute, and author of twelve books including the best selling Web of Debt. Her

latest book, The Public Bank Solution, explores successful public banking models historically and globally. Her 300+ blog articles are at

EllenBrown.com.

Link to Article - http://ellenbrown.com/2015/07/03/a-revolutionary-pope-calls-for-rethinking-the-outdated-criteria-that-rule-the-world/

Also on others...http://www.huffingtonpost.com/ellen-brown/a-revolutionary-pope-call_1_b_7728626.html

Switzerland To Vote On Ending Fractional Reserve Banking

By Tyler Durden

Published on Zero Hedge (http://www.zerohedge.com) - Created 12/24/2015 - 15:43

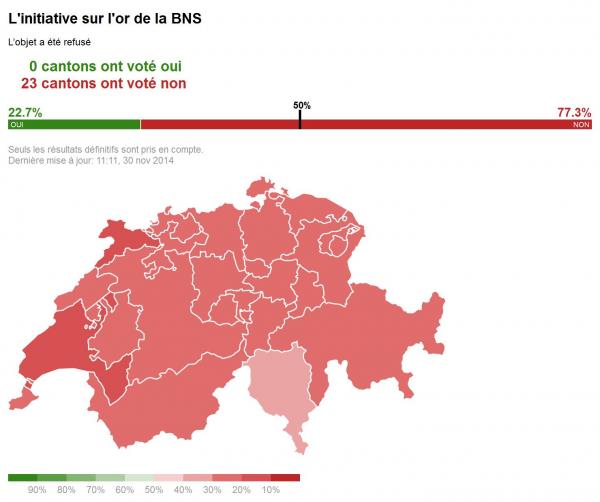

One year ago (and just two months before the shocking announcement the Swiss Franc's peg to the Euro would end,

dramatically revaluing the currency, and leading to massive FX losses around the globe and for the Swiss National Bank) the

Swiss held a referendum whether to demand that their central bank should convert 20% of its reserves into gold, up from 7%

currently. After the early polls showed the Yes vote taking a surprising lead, the Diebold machines kicked in and the result was

a sweeping victory for the No vote, without a single canton voting for sound money.

Ironically, this unexpected nonchallance about the Swiss central bank's balance sheet by one of Europe's more responsible

nations took place just before the same bank announced CHF30 billions in losses on its long EUR positions following the

revaluation of the CHF. It also took place when not just Germany, but the Netherlands and Austria announced they would

repatriate a major portion of their gold in a move which, all spin aside, signals rising concerns about the existing monetary

system.

We wonder if the Swiss have changed their mind about just how prudent it is to have their central bank operate as one of the

world's largest - and worst - after its CHF 30 billion loss in Q1 FX traders, and hedge funds with $94 billion in stock holdings,

since then.

We may soon have the answer, because in what is shaping up to be another historic referendum on the treatment of money,

earlier today the Swiss Federal Government confirmed that it had received enough signatures and would hold a referendum as

part of the so-called "Vollgeld", or Full Money Initiative, also known as the Campaign for Monetary Reform, which seeks to ban

commercial banks from creating money, and which calls for the central bank to be given sole power to create the money in the

financial system.

In other words, an initiative to ban fractional reserve banking, and revert to a 100% reserve.

As Finanzen.ch reports, after 111,763 signatures urging a referendum were submitted, of which 110,955 valid, the Federal

Chancellery announced on Thursday that the popular vote would take place. Under Switzerland's direct democracy, a

referendum can be held if a motion gains 100,000 signatures within 18 months of launching.

"Banks wont be able to create money for themselves any more, they only be able to lend money that they have from savers or

other banks," said the campaign group.

Ever since the SNB was established in 1891, it has had exclusive power to mint coins and issue Swiss banknotes. However,

as with every other fractional reserve banking system, over 90% of the money in circulation in Switzerland, as in every other

country, now exists in the form "electronic" cash created by private banks, rather than the central bank.

It is this threat of uncontrolled money creation and the risks to systemic stability that the Vollgeld campaign is seeking to stem.

"Due to the emergence of electronic payment transactions, banks have regained the opportunity to create their own money,"

said the Swiss Sovereign Money campaign. "The decision taken by the people in 1891 has fallen into oblivion."

So with the referendum now docketed, will this vote too be mysteriously "lost" in the final minutes of voting? According to the

Telegraph, unlike the gold vote - which was seen as a precursor to re-introducing the Gold Standard in Switzerland -

economists have been more supportive of the idea of "sovereign money" as a way to stabilize the economy and prevent

excess credit growth.

A date for the Swiss referendum has not been set.

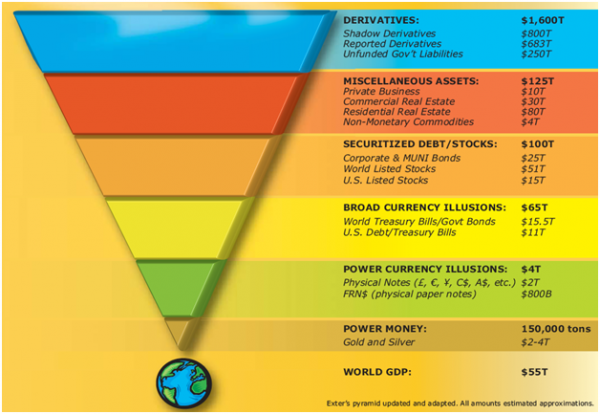

If the vote passes, and if Swiss banks are barred from creating deposits (by way of loans), it would shake to the core the entire

modern financial system, which these days is exclusively reliant on runaway fractionalization of sound money, as more and

more layers are added to the top of the Exter's Pyramid, as the only possible "growth" left in a world that has never seen so

much debt, is to find new and creative ways to borrow from the future, with banks getting all the benefits and stuffing taxpayers

when the inevitable collapse happens.

Below is a pdf provided by the Vollgeld Initiative, responding to popular criticisms against its "100% reserve" crusade.

A Crisis Worse than ISIS? Bail-Ins Begin

Posted on December 29, 2015 by Ellen Brown

While the mainstream media focus on ISIS extremists, a threat that has gone virtually unreported is that your life savings could

be wiped out in a massive derivatives collapse. Bank bail-ins have begun in Europe, and the infrastructure is in place in the US.

Poverty also kills.

At the end of November, an Italian pensioner hanged himself after his entire €100,000 savings were confiscated in a bank

“rescue” scheme. He left a suicide note blaming the bank, where he had been a customer for 50 years and had invested in

bank-issued bonds. But he might better have blamed the EU and the G20’s Financial Stability Board, which have imposed an

“Orderly Resolution” regime that keeps insolvent banks afloat by confiscating the savings of investors and depositors. Some

130,000 shareholders and junior bond holders suffered losses in the “rescue.”

The pensioner’s bank was one of four small regional banks that had been put under special administration over the past two

years. The €3.6 billion ($3.83 billion) rescue plan launched by the Italian government uses a newly-formed National Resolution

Fund, which is fed by the country’s healthy banks. But before the fund can be tapped, losses must be imposed on investors;

and in January, EU rules will require that they also be imposed on depositors. According to a December 10th article on

BBC.com: The rescue was a “bail-in” - meaning bondholders suffered losses - unlike the hugely unpopular bank bailouts

during the 2008 financial crisis, which cost ordinary EU taxpayers tens of billions of euros.

Correspondents say [Italian Prime Minister] Renzi acted quickly because in January, the EU is tightening the rules on bank

rescues - they will force losses on depositors holding more than €100,000, as well as bank shareholders and bondholders.

. . . [L]etting the four banks fail under those new EU rules next year would have meant “sacrificing the money of one million

savers and the jobs of nearly 6,000 people”. That is what is predicted for 2016: massive sacrifice of savings and jobs to prop

up a “systemically risky” global banking scheme.

Bail-in Under Dodd-Frank

That is all happening in the EU. Is there reason for concern in the US?

According to former hedge fund manager Shah Gilani, writing for Money Morning, there is. In a November 30th article titled

“Why I’m Closing My Bank Accounts While I Still Can,” he writes: [It is] entirely possible in the next banking crisis that

depositors in giant too-big-to-fail failing banks could have their money confiscated and turned into equity shares. . . .

If your too-big-to-fail (TBTF) bank is failing because they can’t pay off derivative bets they made, and the government refuses to

bail them out, under a mandate titled “Adequacy of Loss-Absorbing Capacity of Global Systemically Important Banks in

Resolution,” approved on Nov. 16, 2014, by the G20’s Financial Stability Board, they can take your deposited money and turn it

into shares of equity capital to try and keep your TBTF bank from failing.

Once your money is deposited in the bank, it legally becomes the property of the bank. Gilani explains: Your deposited cash is

an unsecured debt obligation of your bank. It owes you that money back. If you bank with one of the country’s biggest banks,

who collectively have trillions of dollars of derivatives they hold “off balance sheet” (meaning those debts aren’t recorded on

banks’ GAAP balance sheets), those debt bets have a superior legal standing to your deposits and get paid back before you

get any of your cash.

. . . Big banks got that language inserted into the 2010 Dodd-Frank law meant to rein in dangerous bank behavior.

The banks inserted the language and the legislators signed it, without necessarily understanding it or even reading it. At over

2,300 pages and still growing, the Dodd Frank Act is currently the longest and most complicated bill ever passed by the US

legislature.

Propping Up the Derivatives Scheme

Dodd-Frank states in its preamble that it will “protect the American taxpayer by ending bailouts.” But it does this under Title II by

imposing the losses of insolvent financial companies on their common and preferred stockholders, debtholders, and other

unsecured creditors. That includes depositors, the largest class of unsecured creditor of any bank.

Title II is aimed at “ensuring that payout to claimants is at least as much as the claimants would have received under

bankruptcy liquidation.” But here’s the catch: under both the Dodd Frank Act and the 2005 Bankruptcy Act, derivative claims

have super-priority over all other claims, secured and unsecured, insured and uninsured.

The over-the-counter (OTC) derivative market (the largest market for derivatives) is made up of banks and other highly

sophisticated players such as hedge funds. OTC derivatives are the bets of these financial players against each other.

Derivative claims are considered “secured” because collateral is posted by the parties.

For some inexplicable reason, the hard-earned money you deposit in the bank is not considered “security” or “collateral.” It is

just a loan to the bank, and you must stand in line along with the other creditors in hopes of getting it back. State and local

governments must also stand in line, although their deposits are considered “secured,” since they remain junior to the

derivative claims with “super-priority.”

Turning Bankruptcy on Its Head

Under the old liquidation rules, an insolvent bank was actually “liquidated” - its assets were sold off to repay depositors and

creditors. Under an “orderly resolution,” the accounts of depositors and creditors are emptied to keep the insolvent bank in

business. The point of an “orderly resolution” is not to make depositors and creditors whole but to prevent another system-wide

“disorderly resolution” of the sort that followed the collapse of Lehman Brothers in 2008. The concern is that pulling a few of the

dominoes from the fragile edifice that is our derivatives-laden global banking system will collapse the entire scheme. The

sufferings of depositors and investors are just the sacrifices to be borne to maintain this highly lucrative edifice.

In a May 2013 article in Forbes titled “The Cyprus Bank ‘Bail-In’ Is Another Crony Bankster Scam,” Nathan Lewis explained the

scheme like this:

At first glance, the “bail-in” resembles the normal capitalist process of liabilities restructuring that should occur when a bank

becomes insolvent. . . .

The difference with the “bail-in” is that the order of creditor seniority is changed. In the end, it amounts to the cronies (other

banks and government) and non-cronies. The cronies get 100% or more; the non- cronies, including non-interest-bearing

depositors who should be super-senior, get a kick in the guts instead. . . .

In principle, depositors are the most senior creditors in a bank. However, that was changed in the 2005 bankruptcy law, which

made derivatives liabilities most senior. Considering the extreme levels of derivatives liabilities that many large banks have, and

the opportunity to stuff any bank with derivatives liabilities in the last moment, other creditors could easily find there is nothing

left for them at all.

As of September 2014, US derivatives had a notional value of nearly $280 trillion. A study involving the cost to taxpayers of the

Dodd-Frank rollback slipped by Citibank into the “cromnibus” spending bill last December found that the rule reversal allowed

banks to keep $10 trillion in swaps trades on their books. This is money that taxpayers could be on the hook for in another

bailout; and since Dodd-Frank replaces bailouts with bail-ins, it is money that creditors and depositors could now be on the

hook for. Citibank is particularly vulnerable to swaps on the price of oil. Brent crude dropped from a high of $114 per barrel in

June 2014 to a low of $36 in December 2015.

What about FDIC insurance? It covers deposits up to $250,000, but the FDIC fund had only $67.6 billion in it as of June 30,

2015, insuring about $6.35 trillion in deposits. The FDIC has a credit line with the Treasury, but even that only goes to $500

billion; and who would pay that massive loan back? The FDIC fund, too, must stand in line behind the bottomless black hole of

derivatives liabilities. As Yves Smith observed in a March 2013 post: In the US, depositors have actually been put in a worse

position than Cyprus deposit-holders, at least if they are at the big banks that play in the derivatives casino. The regulators

have turned a blind eye as banks use their depositors to fund derivatives exposures. . . . The deposits are now subject to being

wiped out by a major derivatives loss.

Even in the worst of the Great Depression bank bankruptcies, noted Nathan Lewis, creditors eventually recovered nearly all of

their money. He concluded: When super-senior depositors have huge losses of 50% or more, after a “bail-in” restructuring, you

know that a crime was committed.

Exiting While We Can

How can you avoid this criminal theft and keep your money safe? It may be too late to pull your savings out of the bank and

stuff them under a mattress, as Shah Gilani found when he tried to withdraw a few thousand dollars from his bank. Large

withdrawals are now criminally suspect.

You can move your money into one of the credit unions with their own deposit insurance protection; but credit unions and their

insurance plans are also under attack. So writes Frances Coppola in a December 18th article titled “Co-operative Banking

Under Attack in Europe,” discussing an insolvent Spanish credit union that was the subject of a bail-in in July 2015. When the

member-investors were subsequently made whole by the credit union’s private insurance group, there were complaints that

the rescue “undermined the principle of creditor bail-in” - this although the insurance fund was privately financed. Critics argued

that “this still looks like a circuitous way to do what was initially planned, i.e. to avoid placing losses on private creditors.”

In short, the goal of the bail-in scheme is to place losses on private creditors. Alternatives that allow them to escape could

soon be blocked.

We need to lean on our legislators to change the rules before it is too late. The Dodd Frank Act and the Bankruptcy Reform Act

both need a radical overhaul, and the Glass-Steagall Act (which put a fire wall between risky investments and bank deposits)

needs to be reinstated.

Meanwhile, local legislators would do well to set up some publicly-owned banks on the model of the state-owned Bank of North

Dakota - banks that do not gamble in derivatives and are safe places to store our public and private funds.

Ellen Brown is an attorney, founder of the Public Banking Institute, and author of twelve books including the best-selling Web of Debt. Her

latest book, The Public Bank Solution, explores successful public banking models historically and globally. Her 300+ blog articles are at

EllenBrown.com. Listen to “It’s Our Money with Ellen Brown” on PRN.FM.

- Great Visions TV

- Inspirations

- Media

- Possibilities

- Astrophysics, Quantum Physics & The Nature of Reality

- Deconstructing Nuclear Fission & Nuclear Waste

- Defense Industry as Community Builders

- Defense Industry As Energy Providers

- Global Water Shortages

- Innovative Technology

- Intelligent Communities & Development

- Pentagon & Non-Western Nations

- Recreating

- Resource Based Population

- Sharing Community Resources

- Protecting Human Rights

- Spiritual Ecology

- Syria

- Write to Us